exeter finance refinance essentials for first-time auto loan shoppers

What refinancing means

Refinancing replaces your current auto loan with a new one that may offer a lower rate, a different term, or both. The goal is to reduce your monthly payment, shrink total interest, or simplify your budget. It hinges on credit, vehicle value, and current market rates.

How it applies to Exeter Finance customers

If your credit profile has improved or rates have dipped, exploring a new loan could make sense. Compare offers carefully, read the fine print, and note any fees, payoff timing, and whether there’s a prepayment penalty on your existing contract. A small APR change can have a big impact over the life of the loan.

Quick checklist

- Get numbers: request your payoff amount and gather income and insurance proof.

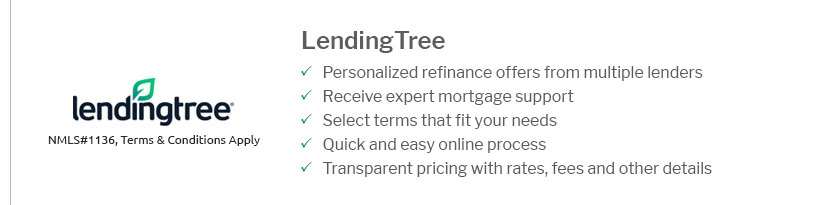

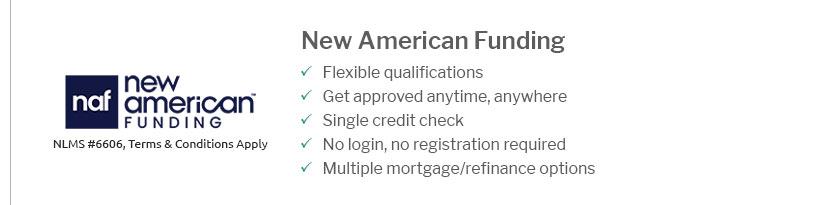

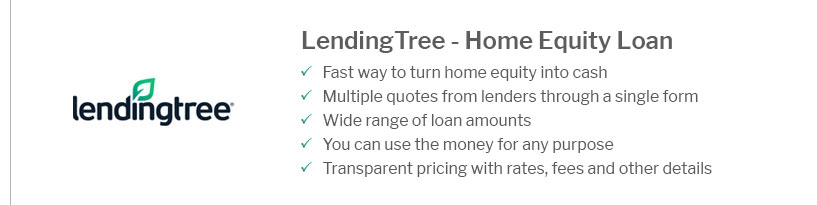

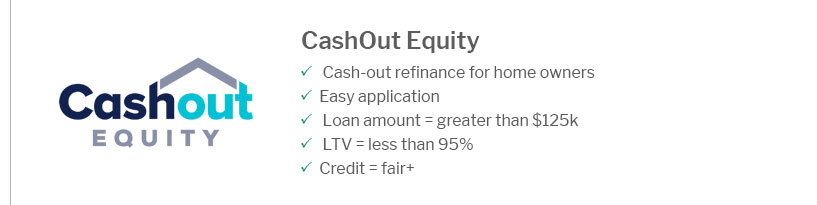

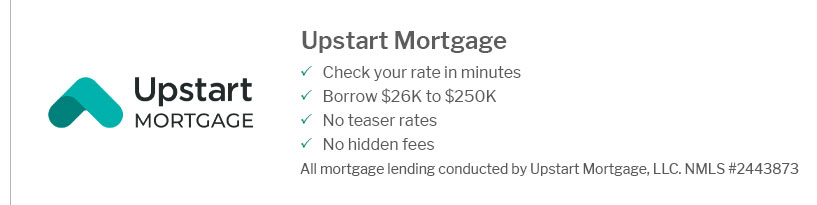

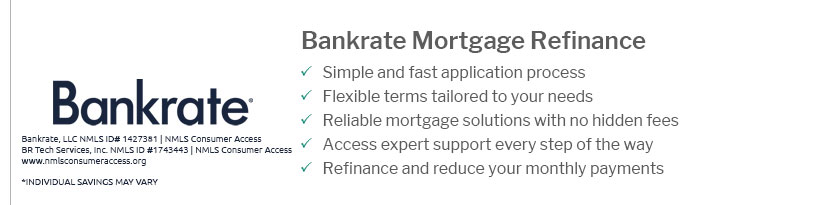

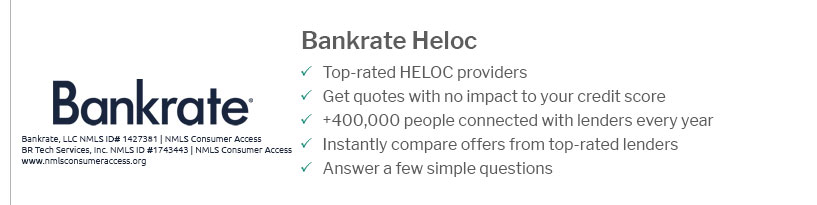

- Shop rates: check multiple lenders and consider term length trade-offs.

- Estimate savings: use a calculator; weigh lower payments against total interest.

- Apply: submit documents, verify identity, and review disclosures.

- Close: ensure the old loan is paid off and confirm title and account details.